Given that Republican presidential nominee Donald Trump has been, up to this point, a businessman rather than a politician and has never held public office, he lacks the political track record by which presidential candidates are typically evaluated. Accordingly, much focus has been directed at his business record — supporters trumpet his business accomplishments (as seen above) and detractors highlight his business missteps (as seen below), with each side seeking to establish his business track record as either good or bad based solely on one small subset of numbers:

In short, this common trope of the 2016 presidential campaign is one that can't be meaningfully evaluated as "true" or "false," because it's too superficial to be informative.

One of the first issues with public perception of the "Trump bankruptcy" trope is that many people don't fully understand the nature of the bankruptcy process, or the distinctions between personal and corporate bankruptcies. Many people tend to view all bankruptcies as something like the denouement of a game of Monopoly: "Ha-ha, you ran out of money! Game over. You lose!"

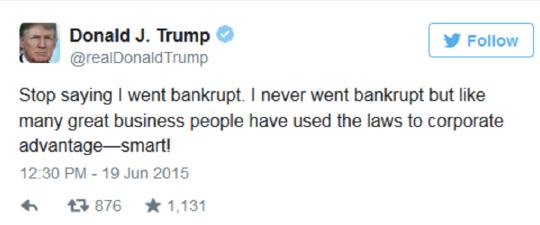

Donald Trump has never declared personal bankruptcy, but he has sought bankruptcy protection for businesses controlled by him several times — as he (or whoever populates his Twitter account) is fond of pointing out:

Although a corporate bankruptcy filing often indicates that a business is in a perilous financial condition, it doesn't necessarily sound the death knell for that business. The provisions of Chapter 11 of the U.S. Bankruptcy Code allow businesses to find ways to reduce their debt and restructure their operations without having to be shut down and liquidated to satisfy debts — instead of closing their doors, businesses can stay open, pay their employees, and take in revenue while developing a budget and a repayment plan for creditors (subject to the approval of the bankruptcy court).

Many of the United States' largest and most prominent businesses have filed for (and emerged from) Chapter 11 bankruptcy protection one or more times, including General Motors, Charter Communications, Delta Air Lines, Kmart, Macy's, and the Texas Rangers baseball team.

Conversely, the absence of bankruptcy declarations is not an indicator of success, as many businesses fail without going through bankruptcy proceedings. A failed business may simply cease operations; with the owners and investors absorbing the losses (if any); a troubled business on the brink of going under may seek to merge with another company that has the resources to keep it afloat and out of bankruptcy; or a dying business may be bought up by another, stronger company, seeking to breathe new life into it or simply to acquire its assets.

And since many business conglomerates comprise multiple companies — each of which may offer many different product lines — a given company or product may fail spectacularly and rack up losses in the hundreds of millions of dollars (e.g., the Ford Edsel, New Coke, and Cutthroat Island) without necessarily sending their corporate parents reeling into bankruptcy.

Finally, all bankruptcies are not created equal. A small startup partnership that doesn't quite take off soon enough and seeks bankruptcy protection is quite a different kettle of fish than the corporate entity that is mismanaged so badly and/or for so long that it racks up billions of dollars in debt before going Chapter 11.

Trump-controlled businesses have sought bankruptcy protection several times after those entities — nearly all of them casino properties — were several hundreds of millions of dollars or more in debt (although the exact number of bankruptcies tied to Trump is debatable, as his spokespeople routinely disclaim that "many of the filings occurred when Trump was no longer involved in the businesses"):

#1) Trump Taj Mahal (1991): The Trump Taj Mahal casino in Atlantic City opened in 1990, with Trump financing the completion of its construction with $675 million in junk bonds at 14% interest. By the following year the casino itself was in debt to the tune of $3 billion, while Trump himself owed some $900 million in personal liabilities.

In order to keep the Taj Mahal afloat, Trump struck a deal with his lenders in which he gave up half his ownership share and equity in the casino, sold his Trump Shuttle airline and his Trump Princess 220-foot yacht, and agreed to a bank-set limit on his personal spending in exchange for a lower interest rate and additional time to make his loan payments.

#2 and #3) Trump's Castle and Trump Plaza Casinos (1992): Less than a year after the Taj Mahal bankruptcy Trump filed for Chapter 11 protection again for two more Atlantic City hotel-casinos, the Trump Plaza and Trump's Castle, over their inability to make principal and interest payments on bonds. The Plaza ($550 million in debt) and the Castle ($338 million in debt) were competing against each other, as well as against the Taj Mahal, and Trump gave up a 50% share in exchange for more favorable terms on the debts.

#4) Trump Plaza Hotel (1992): Donald Trump filed for bankruptcy protection a third time in 1992 over the Trump Plaza Hotel on New York's famous Fifth Avenue, overlooking Central Park in midtown Manhattan. Once again, Trump gave up a 49% stake in the property to secure more favorable terms from lenders on the luxury hotel's debt of more than $550 million.

#5) Trump Hotels and Casinos Resorts (2004): In 1995, Donald Trump established Trump Hotels and Casino Resorts as a publicly traded company, an entity that eventually consolidated his three Atlantic City casinos (Trump Taj Mahal, Trump Castle, and Trump Plaza), along with other properties, under one company. In 2004, Trump sought Chapter 11 bankruptcy protection for the company, with filings listing about $1.8 billion in debt. Yet again, Trump's ownership in the business was reduced, from 47% to 27%, in order to obtain more favorable terms from lenders.

#6) Trump Entertainment Resorts (2009): After its 2004 bankruptcy, Trump Hotels and Casino Resorts was renamed Trump Entertainment Resorts (TER), and that latter entity went Chapter 11 in 2009 with a debt of $1.2 billion. Trump fought with his board of directors over how to restructure the company and ended up reducing his ownership share of the business once again (to 10%) and resigning as chairman of the board.

TER sold off the former Trump's Castle (by then renamed the Trump Marina) to Landry's in 2011, who rebranded it as the Golden Nugget Atlantic City. In 2014, Trump filed a lawsuit to bar the continued use of his name on TER's remaining Atlantic City casinos, the Trump Plaza and the Trump Taj Mahal, holding that "the license entities have allowed the casino properties to fall into an utter state of disrepair and have otherwise failed to operate and manage the casino properties in accordance with the high standards of quality and luxury required under the license agreement." Shortly afterwards, TER declared bankruptcy yet again and closed the Trump Plaza casino for good. The Trump Taj Mahal remained with TER, which became a subsidiary of Icahn Enterprises upon emerging from bankruptcy protection in 2016.

As well, Donald Trump has undertaken a number of business projects that ultimately failed (or failed to live up to his lofty projections) without resulting in bankrupcties, including:

On the other hand, Donald Trump has certainly enjoyed his fair share of business successes, particularly from Manhattan real estate investments and building projects, along with golf courses, luxury resorts, and building a brand that has seen his name and likeness applied to diverse efforts ranging from reality TV (The Apprentice) to clothing lines to property development.

So how are we to rate Donald Trump's business acumen in relative terms? Is the cautious businessman who minimizes risk, rarely fails, and shows a moderate return better than the brash businessman who often takes on highly risky pursuits, strikes out a lot, but also hits his share of grand slams? That's too subjective a question for us to answer, and the few numbers offered in this trope aren't very informative.

It's an oft-cited statistic that Donald Trump "has" 515 companies, but a number of those businesses are only connected to him in tangential ways (e.g., through licensing agreements) and aren't owned or directly controlled by him.

It's also an oft-cited statistic that about 80-90% of businesses fail within the first year to eighteen months, but such numbers typically refer to startups and small businesses, while much of Donald Trump's business empire involves expanding and building on existing large business lines and ventures.

Citing four or six failures out of 515 efforts isn't very enlightening in the absence of a real context in which to evaluate those numbers. A pro athlete who won 511 out of 515 matches would be acclaimed among the world's greatest, and a songwriter who hit the Top 40 with 511 out of 515 tunes would be heralded as the preeminent composer of all time. But a doctor who lost four patients out of 515 might find little demand for his services, and a commercial pilot who crashed four times in 515 flights would likely have a hard time finding an employer (or any passengers willing to fly with him). There is no meaningful standard to apply here.

The most important takeaway from this trope might be that you can't sum up the world of big business. much less any presidential candidate's qualifications, with a couple of numbers devoid of explanation or context.

Isidore, Chris. "Everything You Want to Know About Donald Trump's Bankruptcies." CNNMoney. 31 August 2015.

Hylton, Richard D. "1991; Money Movers Caught in the Turbulent Times of the 90's." The New York Times. 31 December 1991.

Harwell, Drew and Jacob Bogage. "What Trump Didn’t Say About His Four Big Business Bankruptcies." The Washington Post. 7 August 2015.

Parmley, Suzette. "A Troubled Empire: Trump Gambled on Junk Bonds, and Lost." Philadelphia Inquirer. 11 August 2004.

UPI. "Trump's Castle and Plaza File for Bankruptcy." 9 March 1992.

Clary, Isabelle. "Trump Pulls Off Last-Minute Deal." 17 June 1991.

Parmley, Suzette. "A Troubled Empire: Trump Gambled on Junk Bonds, and Lost." Philadelphia Inquirer. 11 August 2004.

Johnston, David. "Deal Protects Trump Plaza from Bankruptcy." Philadelphia Inquirer. 6 April 1991.

The New York Times. "Trump Castle Refinancing." 9 March 1992.

Buettner, Russ et al. "How Donald Trump Bankrupted His Atlantic City Casinos, But Still Earned Millions." The New York Times. 11 June 2016.

The New York Times. "Trump's Plaza Hotel Bankruptcy Plan Approved." 12 December 1992.

Bingham, Amy. "Donald Trump's Companies Filed for Bankruptcy 4 Times." ABC News.. 21 April 2011.

Associated Press. "Trump Casinos File for Bankruptcy." 22 November 2004.

Palmeri, Christopher. "Trump's Former Atlantic City Jewel Exits Bankruptcy, Now Icahn's." Bloomberg. 26 February 2016.

Parry, Wayne. "Trump: Plaza and Taj Mahal Casinos Too Shabby to Bear His Name Anymore." Associated Press. 6 August 2014.

McQuade, Dan. "The Truth About the Rise and Fall of Donald Trump’s Atlantic City Empire." Philadelphia. 16 August 2015.

Smith, Aaron. "Another Trump-Named Casino in Atlantic City Files for Bankruptcy." CNN Money. 9 September 2014.

Stewart, Emily. "The Backstory on Donald Trump's Four Bankruptcies." The Street. 15 September 2015.